Why Deviation is Just as Important as The Average

That second number is important too

Often, total returns are discussed as an average per year.

It is inappropriate to discuss these numbers without also using the standard deviation.

The standard deviation is a margin of error.

I will also show you how to use that number to understand your risk.

Introduction

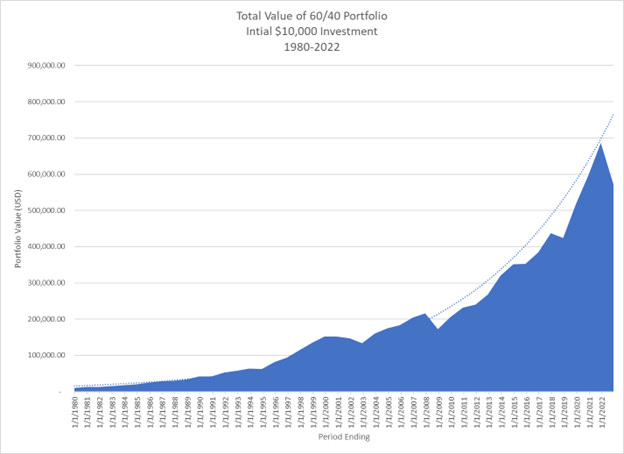

Since the beginning of 1981, a 60/40 portfolio that is invested in Russell 3000 and Bloomberg Aggregate Bond Index has averaged a total annual return of 9.87%. That means that an initial $10,000 investment would be worth $571,724.55. Cool. Let's start investing, and start making money.

The problem is we all know that markets do not have nice smooth curves. They look more like jagged mountains. Here is a chart to show the difference.

As one can see, there are bad years along with good. Seven of the 44 years graphed here were losing years. The reason I highlight this is when someone states an average return, it is important to also include the standard deviation. The average return should be reported as 9.87% (±11.23%).

What Does the Standard Deviation Mean?

Without showing the formula, the standard deviation is the average difference between each data point is from the mean or average. It gives one the idea of a spread. The values within one standard deviation are considered "normal". In our case here, a "normal" return for the 60/40 portfolio is between losing ‑1.36% to gaining 21.10%. Statistically, this should happen 2/3 of the time or 68%. Additionally, 95% of the returns happen with two standard deviations of the mean. That means most returns were between losing ‑12.59% to gaining 32.33%. It is believed here that this gives one a clearer understanding of historical market returns.

How Does the Standard Deviation Help Me Understand Risk?

This is important for one to understand their risk tolerance. If this portfolio strategy loses more than ‑1.36% one out of six times, and there is a 1 in 40 chance of losing more than -12.59%, you the client need to fully understand that. If this also means that you would have made money about 80% of the time. This helps your financial advisor to tailor a portfolio strategy that will meet your risk profile.

Conclusion

The reason one needs a financial advisor is one can help to understand risks, and how those might affect the overall performance of one’s portfolio. One needs to understand that there is volatility or risk to investing, and there are times when there is too much risk for one to

References

I want to thank Franklin Templeton for allowing me to use their resources.

Disclosures

Securities are offered through Avantax Investment ServiceSM, Member FINRA, and SIPC. Investment advisory services offered through Avantax Advisory ServicesSM.

These opinions are based on observations and research and are not intended to predict or depict

the performance of any investment. This information is intended to be for illustrative purposes only and

does not reflect any particular investment or investment needs of any specific investor. The information

is based on sources believed to be reliable; however, their accuracy or completeness cannot be

guaranteed. These views should not be construed as a recommendation to buy or sell any securities.

Investment decisions should be based on an individual's own goals, time horizon, and risk tolerance.

Investing involves risk, including the risk of loss of principal.

Content is not to be construed as a recommendation or determination of suitability.

This presentation represents the past performance of one or more indexes and should not be considered indicative of future results. It is impossible to invest directly in an index.

Cedar Green Financial (DBA) is not a registered broker/dealer or registered advisory firm.