Introduction

As a financial literacy teacher, I wanted to show you the formulas behind our investments and their returns. I hope all other teachers will find this to be useful resource with several necessary formulas for their curricula right here. For each formula, will give an example problem, with a solution.

Single Deposit Formulas

Here are the formulas for single deposits. I hope one will notice the evolution of each formula and how important it is for students and users to understand that (1 + r) is the basis for most all these calculations. For our examples, I will use a single deposit of $1,000 for 20 years at 10% per year. Each notation has the following definitions.

· A = Account Value

· P = Principal Deposit

· r = Rate (%)

· t = Time in Years

· n = Periods Per Year

The Simple Interest Formula

A = P + Prt, or

A = P(1 + rt)

So, we have:

A = $1,000(1 + 0.10(20))

A = $3,000.00

The Compound Interest Formula

For our example, we have:

The Periodic (Monthly) Compound Interest Formula

For Example 3, the setup is:

Periodic Investment Plans

For our examples here, we are still going to assume an annual return of 10%, but our deposits will be in increments of $100/month or $1,200/year. We will still use 20 years for our calculations. There is one added component, where we will assume an annual inflation rate of 3%.

Systematic (Annual) Investment Plan

Example:

Systematic (Monthly) Investment Plan

Example:

Step-Up Investment Plan (Annual Only)

For those of us who want to increase our deposits, we can use a step-up investment formula. Because we are increasing our deposits, we added a variable (i) for the annual increases.

For our example, we will still assume a 20-year plan with an initial $1,200 annual deposit. Our return will be 10% per year, but we will increase our deposit by 3% per year.

The Withdrawal Formulas

You have now spent years saving and investing for your goal. It is now time to take contributions from your investments. The question is, how much do you take to make sure your money lasts? Here are three formulas to help.

Simple Withdrawal Formula

Here is a formula for simple withdrawals. One might note similarities with the simple interest formula. For our purposes in this section, are variables are:

· W = Withdrawal Amount

· P = Principal Balance

· r = Real Rate of Investment Growth

· n = Number of Withdrawals Per Year

· t = Time in Years

For our examples, we have a $100,000 account, and we want it to last 20 years. Here is the math for stretching out our account for that period over a monthly basis.

Systematic Withdrawal Formula

As one can see, our previous example did not account the internal growth in the portfolio. We need to adjust for that by assuming there will be an annual growth (r). Here is the formula:

For our example, I will still assume a $100,000 portfolio where we want to take monthly distributions for 20 years. I will also assume that our portfolio will grow 7% per year. Here are the results:

Systematic Withdrawal with Step-Up Formula (Annual Only)

Our withdrawal formulas do not account for inflation. We would like to set ourselves up for two goals where 1) we take withdrawals to meet our needs for 20-years, and 2) account for the annual increase in costs over time. First, there needs to be adjustments for our value for our rate (r). We can no longer use 7% as our value if our inflation rate is also 3%. If we use 7% as our growth rate (g), we can find a real rate of return for r. Here is the formula and the new rate:

We can now calculate an initial annual withdrawal from our $100,000 account using 3.88% as our real growth rate. Here are the results:

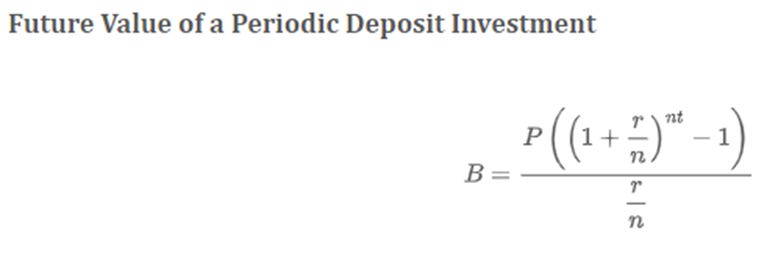

A Note About Cengage’s Financial Algebra Textbook

The adopted textbook for Math for Data and Financial Literacy in our school district is Financial Algebra: Advanced Algebra with Financial Applications by Gerver and Sgroi (2021). In its chapter for banking services, this is what they have for as the formula for systematic investments:

From Cengage Financial Algebra

This is clearly not correct, and I plan to let the school district know. Cengage’s review process should have been better.

I hope my colleagues will find this post useful, and encourage all of them to reach out to me.

Good luck and have fun.