Is Hedging Worth the Effort?

Should one include hedge funds in there portfolio?

Introduction

In my last posting, I posited whether it was time to seek investments outside the S&P 500. In that piece, I discussed different indices and asset classes that outperformed the traditional index. In another post, I asked the question of whether gold was a solid investment and illustrated how it might reduce one’s overall risk. Here, I want to explore alternative investments as defined by the Credit Suisse Hedge Index.

The Credit Suisse Hedge Index is a family of indices that measure the performance of hedge funds across various strategies, regions, and asset classes. The index is based on the data from the Credit Suisse Hedge Fund Database, which covers over 9,000 hedge funds and accounts for about 75% of the estimated assets under management in the hedge fund industry.

Some of the sub-indices under the Credit Suisse Hedge Index are:

Credit Suisse Liquid Alternative Beta (LAB) Index: This index aims to replicate the aggregate return profile of hedge funds using liquid, tradable instruments.

Credit Suisse Managed Futures Hedge Fund Index: This index represents the performance of managed futures hedge funds that use systematic, trend-following strategies to trade futures and options contracts on various markets.

Credit Suisse LEA Hedge Fund Index: This index provides insight into three specific regions of the emerging markets hedge fund universe: Latin America, EEMEA (Emerging Europe, Middle East and Africa), and Asia.

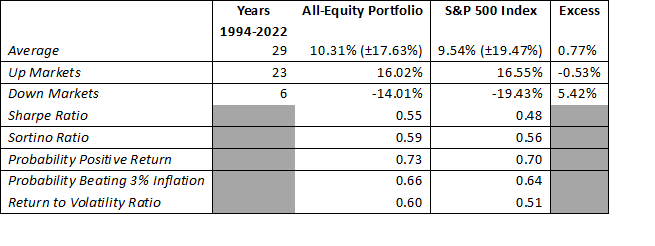

All Equity Performance

First, I wanted to see if simply allocating an all-equity portfolio would suffice in reducing the overall risk of one’s investments. To test the theory, I used this allocation:

37% S&P 500

34% S&P Midcap 400

29% S&P Small Cap 600

These are the results from 1994-2022:

As one can see, this is a promising start at beating the S&P 500 with a lower rate of risk. Now, while I might be willing to invest in an all-equity portfolio, it is not for everyone. Given that, let us explore adding other asset classes to our portfolio.

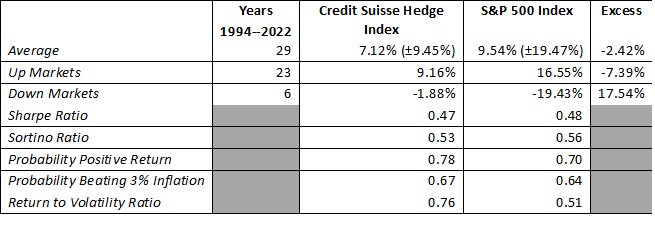

Hedge Index Returns

Thankfully, the Credit Suisse Hedge Index has total return data since 1994. Here is what I found:

The S&P 500 is a better performer over time. The goal of hedging, however, is to reduce risk, and not necessarily beat the market. In that aspect, hedging pursies that goal. Based on the provided evidence, hedging reduces losses during down years and cuts the volatility in half. Additionally, the probability of a positive return is greater with hedge funds than it would be with just investing in the S&P 500.

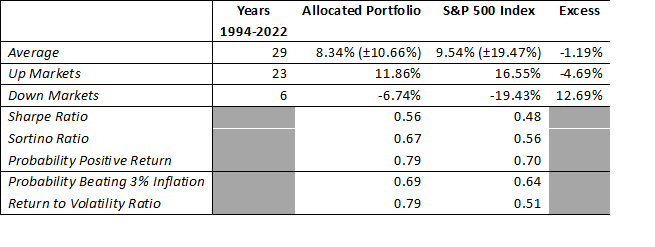

Adding Hedge Funds to An Overall Portfolio

Since I have already analyzed the effects of fixed income and gold on one’s overall portfolio, I wanted to see how adding hedging strategies affects the overall performance of the portfolio. For illustrations, I used my risk profile to develop a portfolio without hedging, and one with hedging.

Here is the asset allocation I developed for myself that does not include hedging strategies:

34% Aggregate Bond Index

25% S&P 500

21% S&P Midcap 400

16% S&P Small Cap 600

4% Gold

Here are the results since 1994:

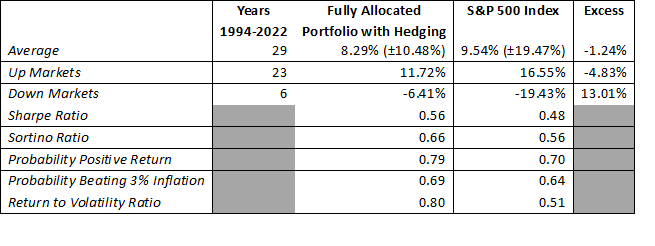

Now, let me add some hedge funds to my allocation with the following portfolio:

30% Aggregate Bond Index

23% S&P 500 Index

19% S&P Midcap 400 Index

15% S&P Small Cap 600 Index

3.5% Gold

9.5% Credit Suisse Hedge Index

Here are the results since 1994:

My Take

It is well established that one should design appropriate portfolios that match their risk tolerance profiles. The question here is whether hedge funds are appropriate for portfolios. The initial data does indicate that at worst, hedge funds do not hurt one’s asset returns, and at best can provide for some relaxation of the risks one assumes when they invest. The data does show that hedge funds, in terms of risk data, do provide some benefit to the investor. As a disclosure, I do use written covered call options and covered call ETFs as strategies to fulfill that part of my asset allocation. Compliance prevents me from sharing those ETFs with you, but I am always glad to share what I do when we speak.

Flourish and Grow

References

I want to thank MFS and Invesco for sharing their data with me.

Damodaran, A. (2023, January). Historical Returns on Stocks, Bonds and Bills: 1928-2022. Retrieved from NYU Stern School of Business: https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

Disclosures

Securities are offered through Avantax Investment ServiceSM, Member FINRA, and SIPC. Investment advisory services offered through Avantax Advisory ServicesSM.

These opinions are based on observations and research and are not intended to predict or depict

the performance of any investment.

This information is intended to be for illustrative purposes only and does not reflect any particular investment or investment needs of any specific investor.

The information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. These views should not be construed as a recommendation to buy or sell any securities.

The S&P 500 index tracks the shares of 500 large publicly traded companies in the United States. One cannot invest directly in the S&P 500.

The Russell 2000SM Index is an unmanaged market capitalization-weighted index measuring the performance of the smallest 2,000 companies in the Russell 3000SM Index.

The Russell Midcap Index is an unmanaged index that measures the performance of the 800 smallest companies in the Russell 1000SM Index, which represent approximately 26% of the total market capitalization of the Russell 1000SM Index.

The rates of return shown above are purely hypothetical and do not represent the performance of any individual investment or portfolio of investments. They are for illustrative purposes only and should not be used to predict future product performance. Specific rates of return, especially for extended periods, will vary over time. There is also a higher degree of risk associated with investments that offer the potential for higher rates of return. You should consult with your representative before making any investment decision.

Investments are subject to market risks including the potential loss of principal invested.

Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment losses.

Asset allocation does not assure or guarantee better performance and cannot eliminate the risk of investment losses.

Past performance does not guarantee future results.

The securities of smaller, less-known companies may be more volatile than those of larger companies.

An investment cannot be made directly into an index.

Investing in alternative investment products are considered speculative and involve additional risks. Investors seeking to invest in alternative investments or employ alternative investing strategies should understand and be willing to accept the associated risks. Alternative investments can be highly illiquid and no secondary market may exist for the redemption of shares, may increase the risk of loss of investments due to employing leverage and other speculative investment practices, have volatile performance, may include higher fees, and may not be subject to regulatory filing requirements and also may not be required to provide periodic pricing or information related to the valuation of the investment to investors.