Bitcoin Is Not for Me

Introduction

As I go into my second semester in my financial literacy classes, I am preparing units about investing. I will eventually be asked whether one should invest in Bitcoin. I will always come to the same conclusion. Bitcoin is not for me. In the end, one can invest their money as they see fit, but for me, too many issues regarding Bitcoin led to my hesitation in investing in such a speculative venture. Here, I will explain my thoughts.

What Bitcoin Is and Is Not

Bitcoin is a digital or virtual currency that operates independently of any central authority, such as a government or financial institution. It was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin transactions are recorded on a public ledger called the blockchain, which ensures transparency and security. In theory, it is supposed to be:

· Decentralized, where no single entity controls the currency.

· Limited, where there will only ever be 21 million bitcoins.

· Easy to use with peer-to-peer transactions without going through a financial institution.

· Private, where the transactions are transparent, but the parties’ identities remain anonymous.

These features of Bitcoin will lead to specific problems, which are enough to scare off any prudent investor.

Decentralization

The decentralized nature of Bitcoin requires all transactions to go through dedicated computers and can slow down transactions. Additionally, the amount of energy that must be consumed to make all this work has led to additional issues, including discussions about renewing nuclear-generated electricity.

Limited Supply

Because of the fixed supply of Bitcoin, we are already seeing the issue of hoarding rather than spending. This can lead to less spending and cause deflationary pressure. Because of the limited supply, the market speculation has led to a lot of volatility.

Peer-to-Peer Transactions

Once a Bitcoin transaction has occurred, it cannot be reversed. The money is gone forever. We have also seen several instances of security risks where once private keys are lost or stolen the bitcoins are gone forever.

Pseudonymity

Because transactions are anonymous, regulators are having a challenging time tracking and preventing Illegal activities. The activities include money laundering, tax evasion, and funding illicit activities. Ironically, it turns out that some of the anonymity is an illusion. Bitcoin transactions are kept on a public ledger. With enough scrutiny, it is possible to link transactions to real-world identities.

My take on Bitcoin is that it is nothing more than a computer program. It is made up of bits, bytes, ones, and zeros; nothing more. Its good faith and credit are backed up by no one. It is not insured. I do not even view it as money, but rather, as a speculative game that will have many losers in the end.

The Greater Fool

The “Greater Fool Theory” suggests that the price of an asset can continue to rise if there are more investors (fools” willing to buy at the higher price. Intrinsic value no longer matters to the fools. One hopes to buy the overvalued asset with the hope that someone else (a greater fool) will buy it for a higher price.

Bitcoin is based on this theory. Any investment that can be influenced by sentiment, hype, tweets, blogs, and the like is subject to the phenomenon of the greater fool. Bill Gates agrees with this, so one is in good company if one believes it too. I know this much, I do not want to be the last fool to show up to the Bitcoin party as the lights are turning off.

Too Much Volatility

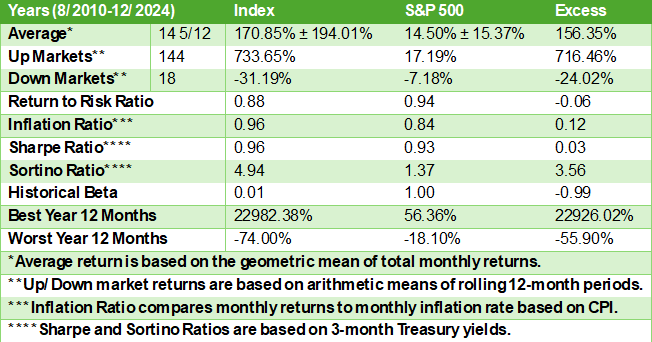

The numbers for Bitcoin as they relate to the S&P 500 are breathtaking and head-scratching also. Here are the numbers since 2010.

If one were to look at most of these numbers, there is some justification for investing in Bitcoin. Its overall performance per annum is spectacular (170.85% v. 14.50%). It performs better against inflation (0.96 v. 0.84) and against the risk-free rate (0.96 v. 0.93). It also has better control over downside deviation (4.94 v. 1.37). On the face of it, Bitcoin is a 4-star investment. There is more though, and that is enough for me to avoid digital currencies as investments. That standard deviation (194.01%) is scary and has shown its ugly face when things go haywire for BTC. I am not sure many of us dare to watch our investments melt away during a 74.00% loss.

My Take

I have always contended it is better to invest in hard assets (i.e., gold) and those assets that support digital currencies (blockchain). While Bitcoin will remain in existence, the federal government will eventually come down hard with laws to control illegal activities, transparency, and oversight. We saw an example of this in 2019 when China acted against Bitcoin. For now, I do not recommend it.

Flourish and Grow

Disclosure

The Content is for informational purposes only, so you should not use any such information or other material as legal, tax, investment, financial, or other advice.